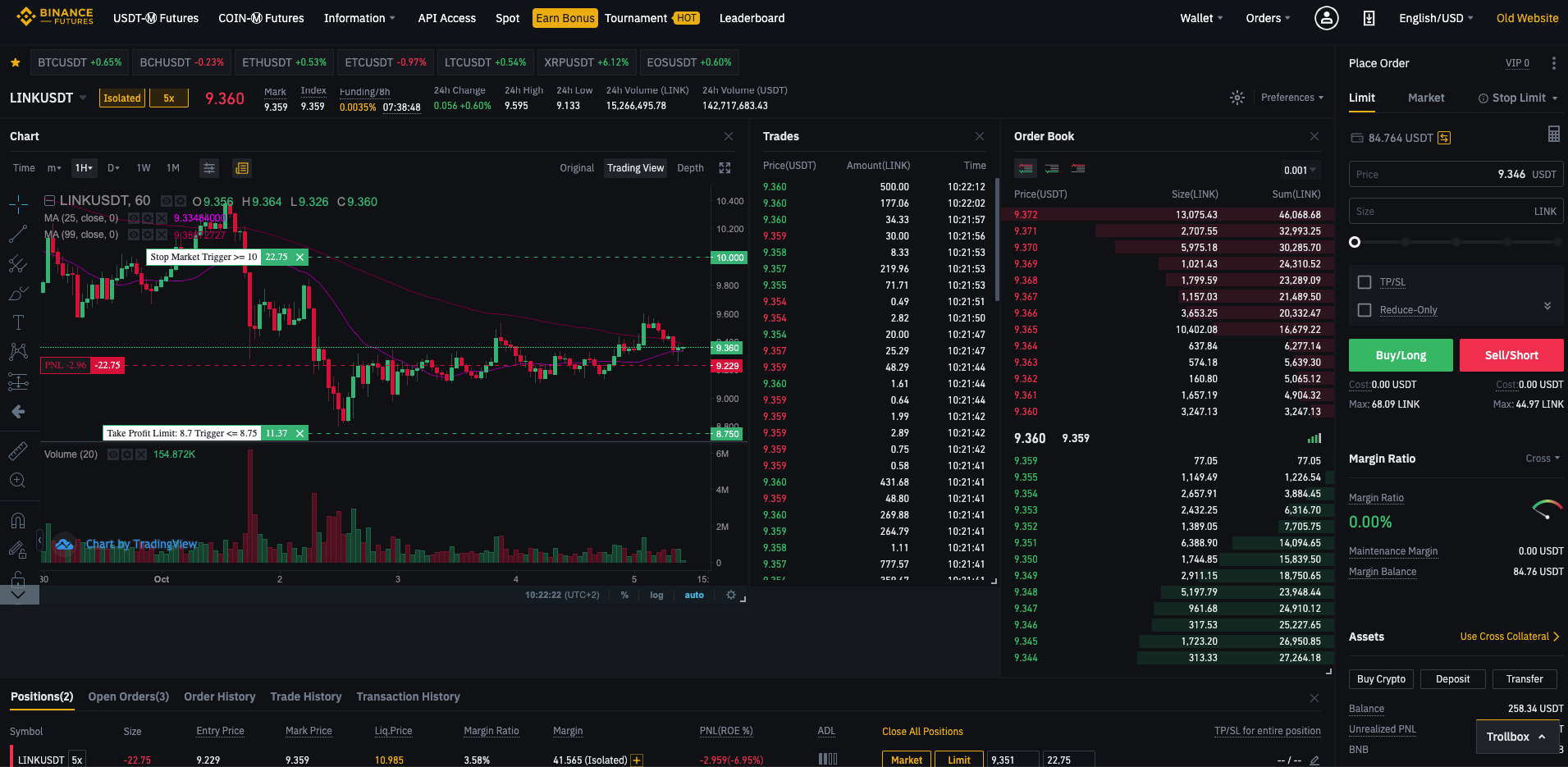

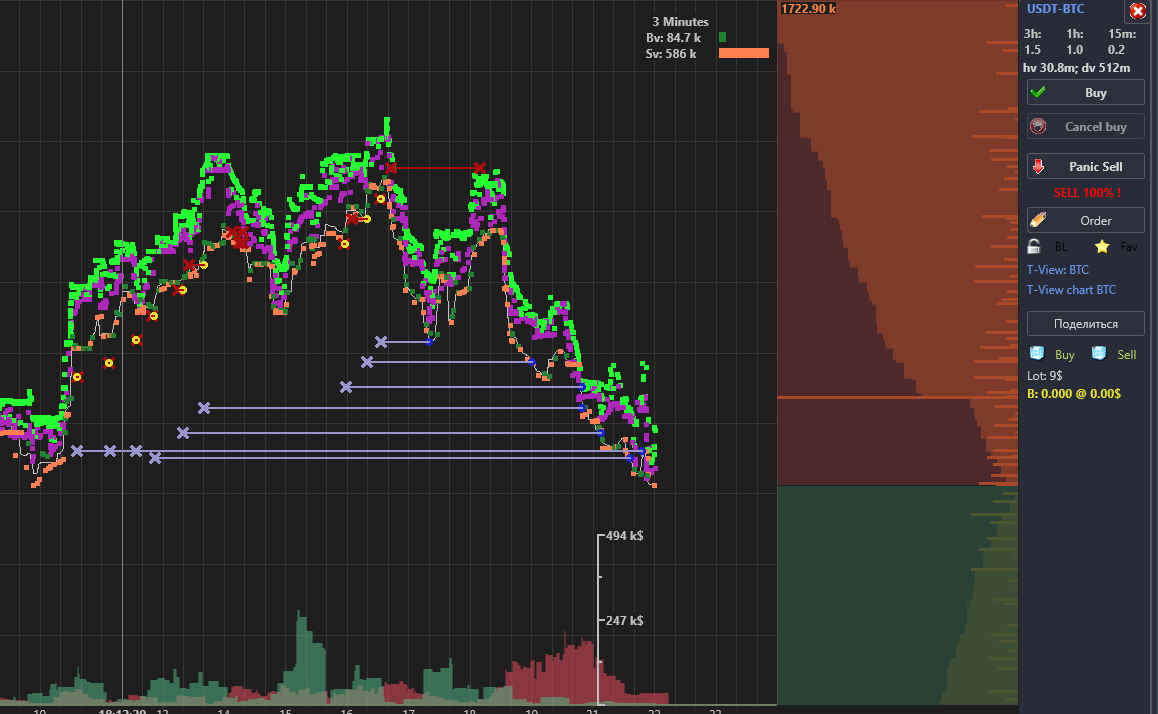

How to Open a Binance Futures Account:īefore opening a Binance Futures account, you’d need to open a regular Binance account. The great thing about crypto futures is that they allow investors to bet on the price of cryptocurrencies even without owning them, so they also enable people who cannot trade in the actual cryptocurrencies because of location-specific issues to bet on the prices of said cryptos.Ĭrypto futures work the exact same way as the futures that speculate on the prices of tangible assets.īy forecasting whether the price of a particular crypto would rise or fall at a specific time and date in the future, investors can decide to go for a long or short position on a crypto futures contract. When it comes to crypto futures contracts, the counterparties wager on the price of a particular crypto coin at a certain point in time in the future. Futures exchanges are necessarily the platforms where futures contracts are traded and sealed. A futures contract works as a buffer when it comes to the ever-changing prices of particularly volatile assets that are traded frequently. While this might or might not turn out to be a profitable bargain, it’s important to keep in mind that the whole point of a futures contract is risk mitigation, and not increased profits. Once a futures contract has been agreed upon, all involved parties must carry through with it at the predetermined price, regardless of the product’s market price at the time of the contract’s termination. So futures allow counterparties to trade upon the projected future price of an asset. In the simplest of words:įutures are derivative products – a contract where counterparties agree to buy or sell a particular asset at a certain price on a specified date and time in the future. Well, first, we are going to find out what futures are. Trades on Binance Futures occur quite similarly to the general Binance exchange platform, with a few notable exceptions.īut before we get into the workings of Binance Futures, let’s take a detailed look at what crypto futures are about, shall we? What are Crypto Futures?

See fetchBalance() + info in the response to get your positions. See what kind of leverage is being applied to the Margin order

That is done by placing more buy/sell orders with the same position.

Yes, with maybe a few little differences.ĬreateOrder() + optional param overrides as explained in the Manual.

Binance futures code#

Will this same code work when accessing the servers on the Binance FUTURE exchange?

0 kommentar(er)

0 kommentar(er)